From www.tomshardware.com

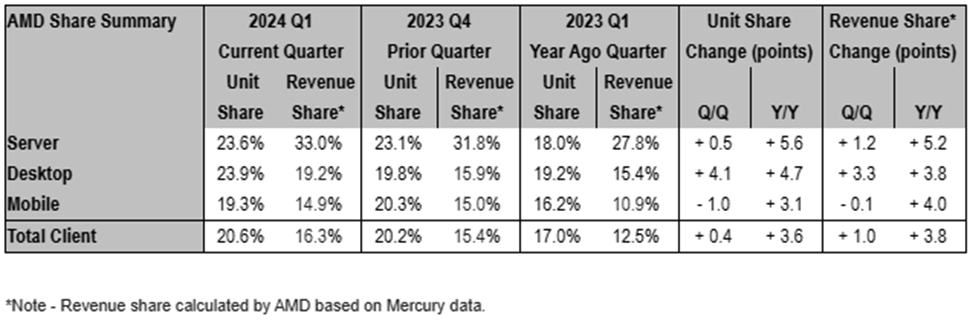

AMD managed to gain both unit and revenue market share in server and consumer PCs in the first quarter of the year as demand for 4th-Generation EPYC processors set another record, whereas Ryzen 8000-series processors were popular with makers of desktop PCs and notebooks. A new report from CPU market tracker Mercury Research outlines several of AMD’s advances during the quarter.

“Mercury noted in their first quarter report that AMD gained significant server and client revenue share driven by growing demand for 4th Gen EPYC and Ryzen 8000 series processors,” a statement by AMD shared by the company via email reads.

Looking at the total client market, AMD’s unit share in the first quarter of 2024 was 16.3%, whereas its revenue share was 20.6%. While AMD’s quarter-over-quarter advances may be considered small, the company’s year-over-year increases are nothing but impressive, as the company gained 3.6 percentage points (PP) of unit share and 3.8 PP of the revenue share.

Swipe to scroll horizontally

| Row 0 – Cell 0 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 1Q18 | 4Q17 | 3Q17 | 2Q17 | 1Q17 | 4Q16 | 3Q16 |

| AMD Desktop Unit Share | 23.9% | 19.8% | 19.2% | 19.4% | 19.2% | 18.6% | 13.9% | 20.5% | 18.3% | 16.2% | 17.0% | 17.1% | 19.3% | 19.3% | 20.1% | 19.2% | 18.6% | 18.3% | 18% | 17.1% | 17.1% | 15.8% | 13% | 12.3% | 12.2% | 12.0% | 10.9% | 11.1% | 11.4% | 9.9% | 9.1% |

| Quarter over Quarter / Year over Year (pp) | +4.1 / +4.7 | +0.6 / +1.2 | -0.2 / +0.5 | +0.1 / -1.02 | +0.6 / +0.9 | +4.7 / +2.4 | -6.6 / -3.1 | +2.2 / +3.4 | +2.1 / -1.0 | -0.8 / -3.1 | -0.1 / -3.1 | -2.3 / -2.1 | +0.1 / +0.7 | -0.8 / +1.0 | +0.9 / +2.1 | +0.6 / +2.1 | +0.3 / +1.5 | +0.3 / +2.4 | +0.9 / +5 | Flat / +4.8 | +1.3 / +4.9 | +2.8 / +3.8 | +0.7 / +2.1 | +0.1 / +1.2 | +0.2 / +0.8 | +1.1 / +2.1 | -0.2 / +1.8 | -0.3 / – | +1.5 / – | +0.8 / – | – |

When it comes to processors for desktop PCs, AMD commanded a 23.9% unit share and a 19.2% revenue share in Q4 2024, up from 19.2% and 15.4% in the same quarter a year ago. AMD does not attribute this to the success of any particular product, though it looks like the gains were a result of the ramp of the company’s Ryzen 8000/Ryzen Pro 8000-series for mainstream desktops and their success among PC makers.

Swipe to scroll horizontally

| Row 0 – Cell 0 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | Q419 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 |

| AMD Mobile Unit Share | 19.3% | 20.3% | 19.5% | 16.5% | 16.2% | 16.4% | 15.7% | 24.8% | 22.5% | 21.6% | 22.0% | 20.0% | 18.0% | 19% | 20.2% | 19.9% | 17.1% | 16.2% | 14.7% | 14.1% | 13.1% | 12.2% | 10.9% | 8.8% |

| Quarter over Quarter / Year over Year (pp) | -1 / +3.1 | 0.8 / 3.9 | 2.9 / 3.8 | 0.3 / -8.3 | -0.2 / -6.3 | +0.8 / -5.1 | -9.1 / -6.4 | +2.3 / +4.8 | +0.9 / +4.4 | -0.4 / +2.6 | +2.0 / +1.8 | +1.9 / +0.01 | -1.0 / +1.1 | -1.2 / +2.8 | +0.3 / +5.5 | +2.9 / +5.8 | +0.9 / +3.2 | +1.5 / +4.0 | +0.7 / +3.8 | +1.0 / +5.3 | +0.9 / ? | Row 2 – Cell 22 | Row 2 – Cell 23 | Row 2 – Cell 24 |

On the mobile front, AMD’s unit share increased from 16.2% in Q1 2023 to 19.3% in Q1 2024, whereas its revenue share bumped massively to 16.3% in the first quarter from 10.9% in the same quarter a year ago.

AMD attributes these gains to Ryzen mobile CPU sales nearly doubling year-over-year as new Ryzen 8040 notebooks ramped up. However, AMD’s unit and revenue shares dropped slightly sequentially, possibly as a result of Intel’s Core Ultra ‘Meteor Lake’ launch.

Swipe to scroll horizontally

| Row 0 – Cell 0 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 4Q17 |

| AMD Server Unit Share | 23.6% | 23.1% | 23.3% | 18.6% | 18% | 17.6% | 17.5% | 13.9% | 11.6% | 10.7% | 10.2% | 9.5% | 8.9% | 7.1% | 6.6% | 5.8% | 5.1% | 4.5% | 4.3% | 3.4% | 2.9% | 3.2% | 1.6% | 1.4% | 0.8% |

| Quarter over Quarter / Year over Year (pp) | +0.5 / +5.6 | -0.2 / 5.5 | 4.7 / 5.8 | 0.6 / 4.7 | +0.4 / +6.3 | +0.1 / +6.9 | +3.6 / +7.3 | +2.3 / +4.4 | +0.9 / +2.7 | +0.5% / +3.6 | +0.7 / +3.6 | +0.6 / +3.7 | +1.8 / +3.8 | +0.5 / +2.6 | +0.8 / +2.3 | +0.7 / +2.4 | +0.6 / 2.2 | +0.2 / +1.4 | +0.9 / +2.7 | +0.5 / +2.0 | -0.3 / – | +1.6 / 2.4 | +0.2 / – | Row 2 – Cell 24 | Row 2 – Cell 25 |

In the first quarter of the year, AMD continued its winning streak in the data center CPU market. The company controlled 23.6% of server processors in terms of units and 33% of server CPU revenues. This is up from 18% and 27.8% in Q1 2023, and the gains look quite impressive, to put it mildly.

AMD’s EPYC processors also gained share quarter-over-quarter, which signals that servers based on the company’s 4th-Gen EPYC CPUs are ramping and winning share from Intel.

AMD’s statement reads: “As we noted during our first quarter earnings call, server CPU sales increased YoY driven by growth in enterprise adoption and expanded cloud deployments.”

We’ll add commentary from Dean McCarron of Mercury Research when he sends the full report in the coming days. Stay tuned.

[ For more curated Computing news, check out the main news page here]

The post AMD takes CPU market share from Intel in desktops and servers, but Intel fights back in laptops first appeared on www.tomshardware.com

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546355/intel_13900k_tomwarren__2_.jpg)